Nifty Futures is an investment tool that allows investors to buy or sell a basket of stocks at a future date and at a price agreed upon today. Trading in Nifty Futures offers several advantages to investors, including hedging, leveraged trading, and the potential for returns. This article will explore these advantages in detail, as well as how to invest in Nifty Futures.

One of the key benefits of investing in Nifty Futures is hedging. Hedging is a strategy used by investors to protect their investments from downside risk. Investors can use Nifty Futures to hedge against losses in their portfolios. For example, if an investor owns stocks that are likely to underperform, they can sell Nifty Futures contracts to protect their portfolio from losses. In this way, Nifty Futures can be used to balance out investments made in other sectors.

Another benefit of Nifty Futures is the ability to trade with leverage. Leverage refers to the ability to invest in a security with borrowed funds. Investors can use leverage to increase potential returns. Nifty Futures typically require a small initial deposit, called margin, to open a trade. While leverage can increase returns, it can also magnify losses, so investors should trade with caution.

Investing in Nifty Futures can also offer potential for high returns. Futures prices are often highly sensitive to changes in the market, and investors who master technical analysis, trade and market timing can make significant profits. However, futures trading can also be risky as the prices move quickly and investors can face losses. Proper strategy and risk management rules should be followed to make investing worthwhile.

Investors can also benefit from the reduced cost of trading Nifty Futures. Unlike stocks that involve a hefty brokerage fee, Nifty Futures contracts can be traded with just a fraction of the cost. Additionally, investors can watch over their investments and place trades on platforms offered by brokerage firms, meaning there is no need for in-person trading.

Another advantage of Nifty Futures is that it offers investors the opportunity to trade the market direction. In trading, investors can capitalize on upward or downward trends. In this case, an investor can trade futures contracts when they think the market will go up or trade on the short side when they think it will go down. Investors can also utilize technical tools like trendlines and indicators to take benefits from direction trades.

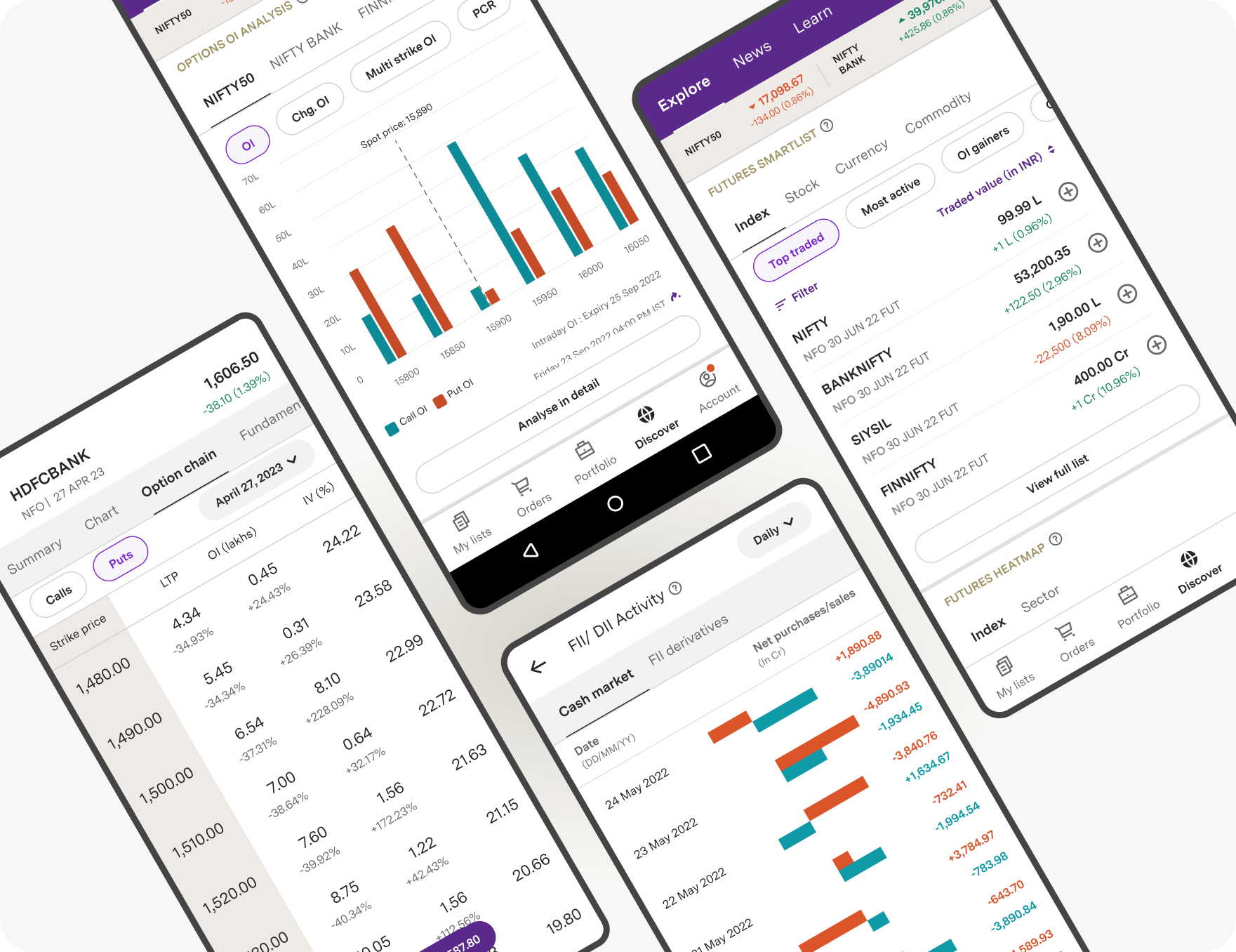

Moreover, Nifty Futures provide price transparency as they are traded on exchanges. This means investors always know the latest prices, allowing them to make informed trading decisions. Futures trading can be monitored real-time on computers, smart phones, and tablets.

When compared with other financial instruments, Nifty Futures is highly liquid. Liquidity refers to the ease and speed with which an asset can be converted into cash. Since the Nifty Futures market is so large and trades are conducted on an exchange, investors can often buy and sell contracts quickly and easily. This means that investors can exit their positions faster than other markets.